As a result, LIFO doesn’t provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today’s prices. Also, LIFO is not realistic for many companies because they would not leave their older inventory sitting idle in stock while using the most recently acquired inventory. More importantly, we will explain how each inventory costing method can impact your business and why you would choose one over the other. Most companies that use LIFO are those that are forced to maintain a large amount of inventory at all times. By offsetting sales income with their highest purchase prices, they produce less taxable income on paper. Last in, first out (LIFO) is a method used to account for business inventory that records the most recently produced items in a series as the ones that are sold first.

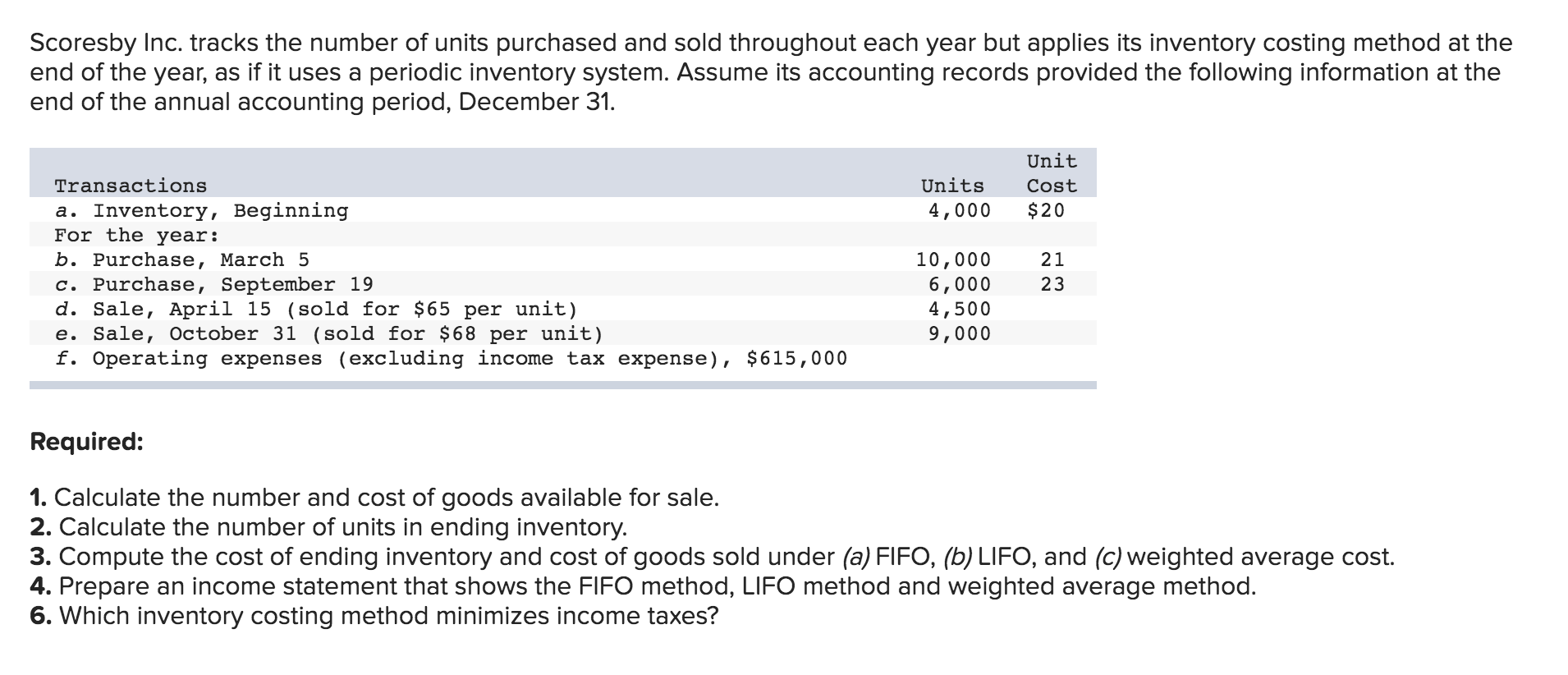

- During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs.

- When sales are recorded using the LIFO method, the most recent items of inventory are used to value COGS and are sold first.

- This method’s biggest issue is that it leaves a grossly understated ending inventory balance that only gets more egregious as time goes on.

- It doesn’t require a high level of operational maturity and can still provide accurate financials with less work.

- For example, if LIFO results the lowest net income and the FIFO results in the highest net income, the average inventory method will usually end up between the two.

- Supporters of FIFO argue that LIFO (1) matches the cost of goods not sold against revenues, (2) grossly understates inventory, and (3) permits income manipulation.

What Types of Companies Often Use FIFO?

Under LIFO, these higher costs are charged to cost of goods sold in the current period, resulting in a substantial decline in reported net income. To obtain higher income, management could delay making the normal amount of purchases until the next period and thus include some of the older, lower costs in cost of goods sold. Under the LIFO method, assuming a period of rising prices, the most expensive items are sold.

LIFO vs. FIFO: Inventory Valuation

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

FIFO

Some accountants argue that this method provides the most precise matching of costs and revenues and is, therefore, the most theoretically sound method. This statement is true for some one-of-a-kind items, such as autos or real estate. For these items, use of any other method would seem illogical. Advantages and disadvantages of LIFO The advantages of the LIFO method are based on the fact that prices have risen almost constantly for decades. LIFO supporters claim this upward trend in prices leads to inventory, or paper, profits if the FIFO method is used. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs.

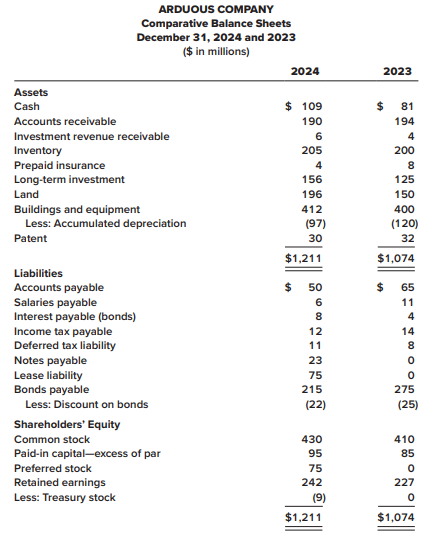

As a result, inventory is a critical component of the balance sheet. Therefore, it is important that serious investors understand how to assess the inventory line item when comparing companies across industries or in their own portfolios. As you can see the value of a company’s inventory does directly impact their reported income and general financial health.

Average Cost

The weighted-average method also allows manipulation of income. Only under FIFO is the manipulation of net income not possible. In addition to being allowable by both IFRS and GAAP users, the FIFO inventory method may require greater consideration when selecting an inventory method. Companies that undergo long periods of inactivity or accumulation of inventory will find themselves needing to pull historical records to determine the cost of goods sold. Since LIFO uses the most recently acquired inventory to value COGS, the leftover inventory might be extremely old or obsolete.

$12, because the first 75 shirts we bought cost $12, so they are the first ones considered sold. All four methods of inventory costing are acceptable; no single method is the only correct method. In periods of deflation, LIFO creates lower costs and increases net income, which also increases taxable income.

Since the seafood company would never leave older inventory in stock to spoil, FIFO accurately reflects the company’s process of using the oldest inventory first in selling their goods. LedgerGurus has a team that specializes in the management of inventory. With our help, you are sure to see an improvement in the profitability and general financial health of your business. the inventory costing method that results in the lowest taxable income in a period of rising costs is: It may be wise to do adjustments periodically (every couple years or so) to all average costs to bring them closer to an average that more accurately reflects recent costs. The first criticism—that LIFO matches the cost of goods not sold against revenues—is an extension of the debate over whether the assumed flow of costs should agree with the physical flow of goods.

Also, LIFO may allow the company to manipulate net income by changing the timing of additional purchases. The Last-In, First-Out (LIFO) method assumes that the last or moreunit to arrive in inventory is sold first. The older inventory, therefore, is left over at the end of the accounting period. For the 200 loaves sold on Wednesday, the same bakery would assign $1.25 per loaf to COGS, while the remaining $1 loaves would be used to calculate the value of inventory at the end of the period. The First-In, First-Out (FIFO) method assumes that the first unit making its way into inventory–or the oldest inventory–is the sold first.

If we switch inventory methods, we must restate all years presented on financial statements using the same inventory method. Inventory is not as badly understated as under LIFO, but it is not as up-to-date as under FIFO. A company can manipulate income under the weighted-average costing method by buying or failing to buy goods near year-end. However, the averaging process reduces the effects of buying or not buying.

Tax benefit of LIFO The LIFO method results in the lowest taxable income, and thus the lowest income taxes, when prices are rising. The Internal Revenue Service allows companies to use LIFO for tax purposes only if they use LIFO for financial reporting purposes. Companies may also report an alternative inventory amount in the notes to their financial statements for comparison purposes. Because of high inflation during the 1970s, many companies switched from FIFO to LIFO for tax advantages. When a company selects its inventory method, there are downstream repercussions that impact its net income, balance sheet, and ways it needs to track inventory.